The BRICS New Development Bank plays a pivotal role in advancing economic research and infrastructure in developing nations. Established with a $100 billion capital base, this institution focuses on fostering renewable energy projects and sustainable development across its member countries. In 2015, India selected Kundapur Vaman Kamath, a seasoned expert in banking, as its inaugural president. Over the initial year, the bank outlined investment policies, structured its operations, and committed funds to five key initiatives in green energy and eco-friendly infrastructure. During an interview with BRICS Business Magazine, K. V. Kamath discussed the bank’s objectives, accomplishments, and strategies for enhancing knowledge sharing and investment among BRICS economies.

Achievements and Future Strategies of the BRICS New Development Bank

In its debut year, the BRICS New Development Bank secured a headquarters agreement, developed operational guidelines, sanctioned initial loans, and launched its first green bonds in China. It also forged partnerships with other multilateral and national development banks. Overall, the institution has aligned with the visions set by BRICS leaders, paving the way for ongoing progress.

Presently, the bank is investigating funding options in local currencies from members like India and Russia, alongside conventional hard currency borrowings such as USD. Simultaneously, it is broadening its collaboration network by negotiating with entities in BRICS and beyond. The bank is reviewing member-submitted projects and aims to activate its Africa Regional Center soon.

For long-term goals, the focus remains on expanding project portfolios and potentially increasing membership to boost global influence and capital.

Organizational Framework and Team Development

The BRICS New Development Bank features five founding members with equal voting rights, ensuring balanced governance. Operations commenced with interim staff, including experts from member governments, national banks, and international bodies. Recruitment is underway, targeting 100 staff by year-end and 350 by 2018.

Rapid technological evolution demands that multilateral banks adapt. They must recruit talent capable of innovating projects that leverage advancements to fulfill societal needs, especially in areas like renewable energy projects and infrastructure financing.

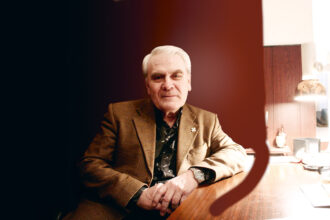

Profile: Kundapur Vaman Kamath K. V. Kamath stands as a prominent figure in India’s banking sector. Starting in 1971 at ICICI Bank, now the nation’s largest private bank, he later handled private sector initiatives at the Asian Development Bank from 1988, overseeing ventures in China, India, Indonesia, Philippines, Bangladesh, and Vietnam. Returning to India in 1996 as ICICI’s CEO and MD, he transformed it into the country’s first universal bank. He stepped down as CEO in 2009, serving as non-executive chairman until 2015, when he became NDB’s first president. Kamath has also chaired Infosys Limited, co-chaired the World Economic Forum in Davos, and served on Schlumberger’s board. Holding a mechanical engineering degree and an MBA from the Indian Institute of Management, Ahmedabad, his contributions have earned accolades like CNBC’s Asian Business Leader of the Year (2001), Forbes Asia’s Businessman of the Year (2007), and The Economic Times’ Business Leader of the Year (2007). In 2008, he received India’s Padma Bhushan award.

Initial Approved Projects in BRICS Nations

Within its first operational year, the bank’s board greenlit projects totaling $911 million, with one per member country.

For Brazil, a $300 million loan to BNDES supports renewable energy projects and transmission lines. This will fund sub-projects in solar, wind, hydropower, and more, adding 600 megawatts capacity via on-lending.

In Russia, $100 million finances two small hydroelectric plants in Karelia, totaling 50 megawatts, channeled through the Eurasian Development Bank and International Investment Bank.

India receives a $250 million sovereign-guaranteed facility to Canara Bank for lending to solar, wind, hydropower, and other projects, yielding 500 megawatts of clean energy.

China’s project involves $81 million equivalent in local currency to Shanghai Lingang Hongbo New Energy Development Co. for rooftop solar in Lingang Industrial Area, providing 100 megawatts.

South Africa gets $180 million for Eskom Holdings to build grid infrastructure for renewable energy projects, including transmission for 670 megawatts and transformation for 500 megawatts from independent producers.

Selection Criteria for Projects

All approved initiatives align with the bank’s emphasis on green energy and sustainable development. They enhance renewable supply and aid the shift to a green economy. Interests extend to transportation infrastructure, sustainability, and cross-member collaboration.

Future support will target projects reducing green technology costs, making them viable to close development gaps.

Emphasis on Renewable Energy

BRICS leaders at the Ufa summit decided the initial projects should center on clean energy. Green infrastructure represents a moral imperative for developing countries, now also economically essential. In some nations, renewable costs match fossil fuels, making them practical and profitable amid falling silicon and solar panel prices.

Projections indicate onshore wind costs dropping 41% per megawatt-hour by 2040, and solar by 60%, becoming the cheapest electricity sources. Actual declines have outpaced estimates.

The BRICS New Development Bank adapts policies to these shifts in infrastructure financing.

Membership Expansion and Access for Low-Income Nations

Per agreements, all UN members can join, with founders planning growth for broader scope and capital. New memberships will proceed orderly.

Annual infrastructure needs in developing countries hit $1 trillion, with MDBs covering only 10-15%. No single entity suffices, so collaboration is key to meet agendas.

Comparison with Asian Infrastructure Investment Bank

Infrastructure demands $1 trillion yearly in developing countries, with MDBs addressing 10-15%. Cooperation, including with AIIB, is vital; the bank will focus on value-adding areas.

Green Bonds and Local Currency Plans

In July 2016, the bank issued a five-year green bond of three billion yuan in China’s interbank market at 3.07%, the first by an MDB there. This bolsters confidence in local markets’ role.

Interactions in St. Petersburg suggest ruble financing potential in Russia. Explorations continue for local currency raises in India and Russia.

Advantages include insulating borrowers from exchange risks; challenges involve market development.

Partnerships with National Institutions

The bank is expanding ties with international and national entities, including public and private. Plans include more engagements across members.

In India, collaboration with ICICI explores rupee bonds; similar partnerships are eyed elsewhere.

India’s Growth and Data Credibility

As NDB president, comments on member economies are avoided. However, IMF and World Bank endorse India’s GDP figures, recently upgrading forecasts.

NDB’s Role in BRICS Growth

BRICS hosts 25% of global population, facing common development hurdles. Beyond financing infrastructure, the bank promotes knowledge, investment, and trade flows.

It prioritizes local currency funding to mitigate risks and integrates technological shifts into models for efficient, scalable development.

For more on developing countries investment, check [Link to related BRICS article]. See also global infrastructure investments from IMF and sustainable development policies from OECD.